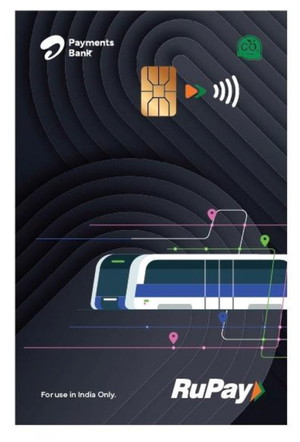

New Delhi (IANS) Airtel Payments Bank on Thursday launched eco-friendly NCMC (national common mobility cards) enabled debit and prepaid cards in partnership with the National Payments Corporation of India (NPCI).

These interoperable cards are powered by RuPay for savings account customers and NCMC-enabled pre-paid cards for wallet customers.

Both cards are being made from eco-friendly e-PVC material, certified for its environmental sustainability, Airtel Payments Bank said in a statement.

“These cards exemplify our dedication to sustainability, emphasising our commitment to delivering a secure and convenient banking experience. We support India’s vision of ‘One Nation, One Card’ and will continue to work towards this,” said Ganesh Ananthanarayanan, Chief Operating Officer of Airtel Payments Bank.

Customers can use these cards to make contactless payments at all merchant establishments, online (e-commerce), as well as offline NCMC transit transactions at metros, buses, parking, etc across the country.

“This partnership emphasises our dedication to meeting the evolving needs of customers, fostering a future where digital transactions in transit are streamlined, secure, and widely accessible,” said Praveena Rai, COO, NPCI.

Customers can order debit cards from the Airtel Thanks App or by visiting the nearest banking points.

The NCMC-enabled prepaid cards will soon be available on online and retail platforms, said the Airtel Payments Bank.