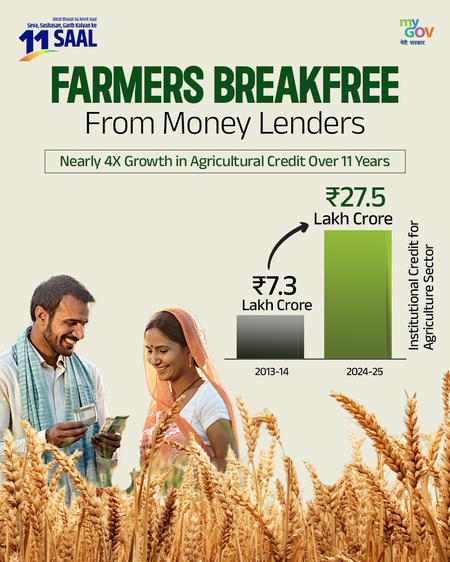

New Delhi – Over the past 11 years under Prime Minister Narendra Modi’s leadership, institutional credit to the agriculture sector has seen a nearly fourfold increase — from ₹7.3 lakh crore in 2013–14 to ₹27.5 lakh crore in 2024–25, the Ministry of Finance announced on Saturday.

Highlighting the government’s farmer-centric policies, the ministry said on X (formerly Twitter), “PM Modi ensured that no annadata (food provider) is left waiting for financial support. Institutional credit to agriculture has grown almost four times in the last 11 years, providing timely and affordable assistance to farmers.”

The government emphasized that this growth has been accompanied by a historic rise in support prices (MSP), timely credit access, record payouts, and improved agricultural infrastructure — all contributing to greater financial stability for farmers.

“From marginal fields to global shelves, India’s farmers are rising like never before,” the statement added.

Since 2014, farmers have benefitted from enhanced dignity and income support through initiatives like the Minimum Support Price (MSP), agricultural infrastructure development, and better access to global markets.

The Kisan Credit Card (KCC) scheme has played a crucial role in this transformation. Designed to offer short-term credit for buying seeds, fertilizers, pesticides, and covering other crop-related expenses, the KCC has become a vital financial tool for millions of farmers.

Finance Minister Nirmala Sitharaman revealed that over 465 lakh KCC applications have been approved, with a sanctioned credit limit of ₹5.7 lakh crore.

Thanks to this scheme, farmers can avail up to ₹3 lakh in loans at just 4% interest, provided they repay on time. An additional Prompt Repayment Incentive (PRI) of 3% further lowers the effective interest rate, helping farmers save as much as ₹9,000 per year on every ₹1 lakh loan.

With inputs from IANS